BXMT: When Fear Meets a Double-Digit Yield

A closer look at fear, yield, and what patience might be worth

1. Why I’m Looking at It

BXMT has been sitting on my watch list for months. The stock is still down near $18 and throwing off a yield north of 10 percent. Every time I see that kind of number attached to the Blackstone name, I get curious. The market is clearly nervous about commercial real estate, but I want to know if the fear has gone too far.

2. Quick Snapshot

Share price: $17.97 (close on 9 Oct 2025)

Dividend: $0.47 quarterly ($1.88 annualized), payable 15 Oct 2025 to holders of record 30 Sep 2025.

Dividend yield (at $17.97): 10.46%

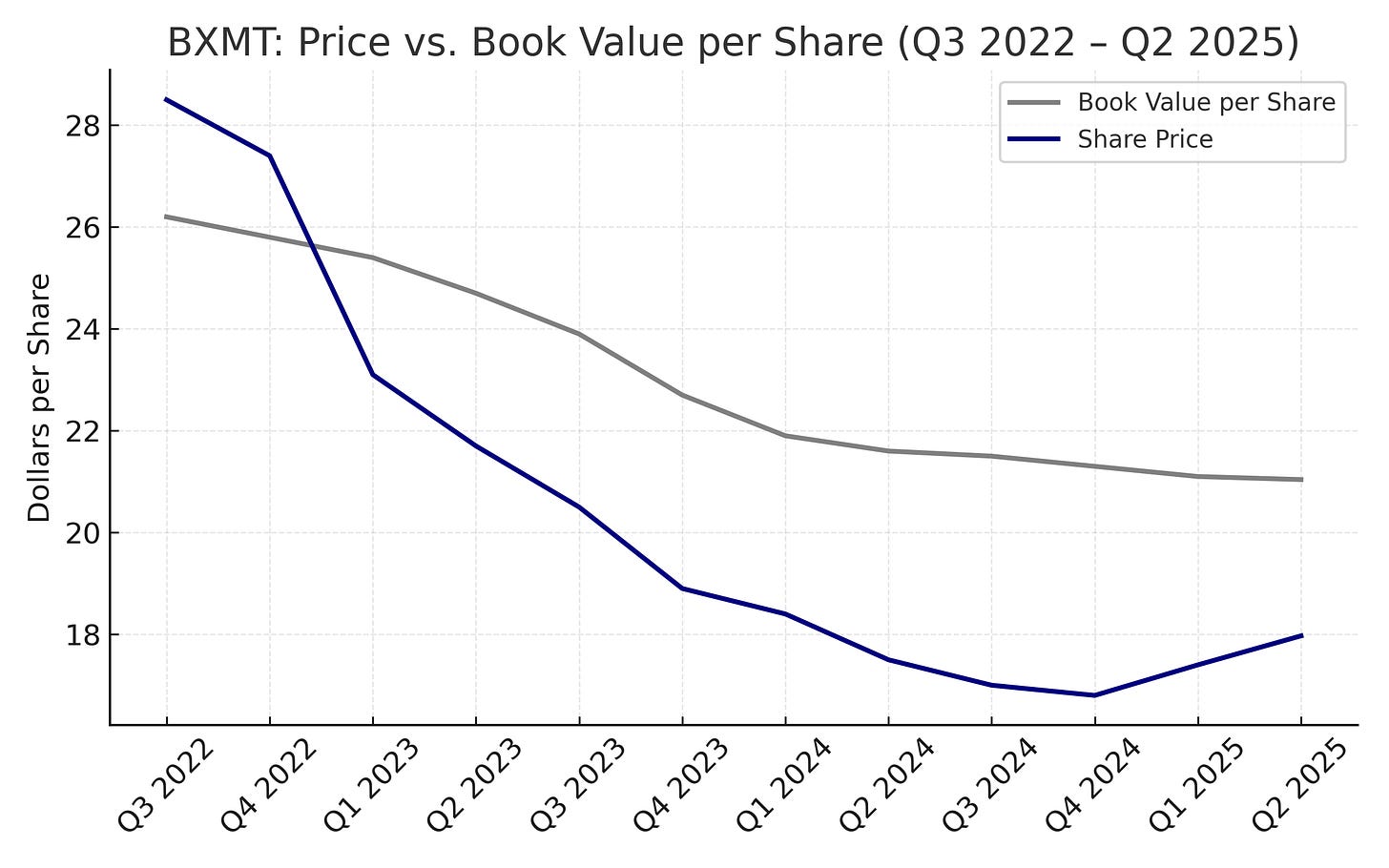

Book value per share: $21.04 (net of a $4.39 per-share CECL1 reserve).

Price to book: ~0.85× at the 9 Oct close.

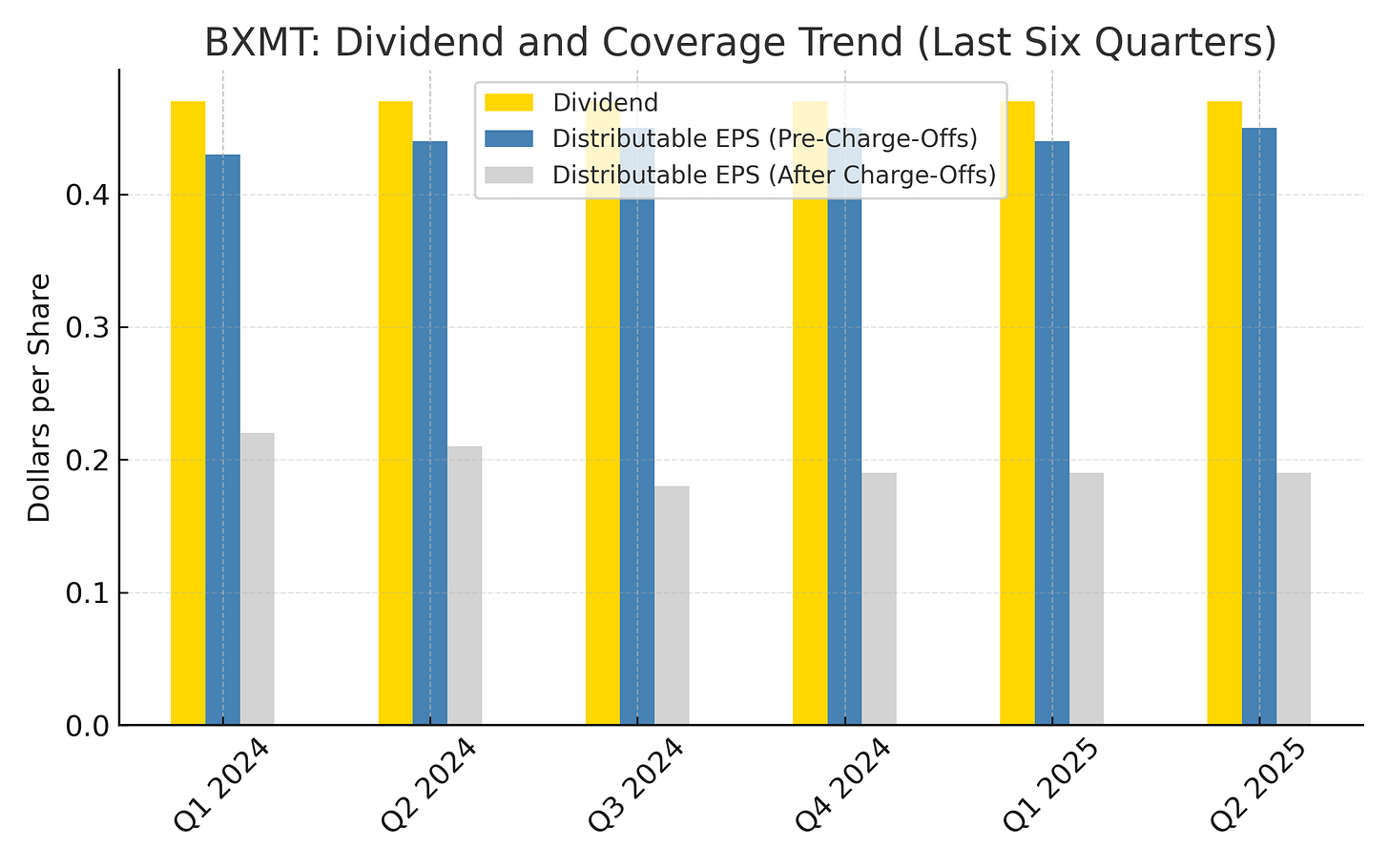

Distributable EPS (Q2 2025): $0.19 reported / $0.45 pre-charge-offs; dividend $0.47.

CECL reserve: ~$755M (3.8% of principal) per company deck.

Portfolio size / loans: $18.4B across 144 loans; 94% performing.

Office exposure: ~28% of the loan portfolio (down from 36% y/y).

Liquidity / leverage: ~$1.1B liquidity; Term Loan B spread reduced by 65 bps in Q2.

Next earnings: 29 Oct 2025 (Q3 results + call).

3. The PYE Lens

In PYE terms, BXMT’s yield is the market’s way of saying investors do not fully trust the book value. A 10 percent plus payout next to a mid-teens discount to BV tells me credit losses are still priced in. My job is to judge whether that discount already reflects the worst or if it has further to go.

BXMT is a mortgage REIT lending mainly first-lien, floating-rate to commercial property owners. The portfolio is $18.4B across 144 loans, 94% performing, with office down to ~28% and a shift toward multifamily and industrial.

BXMT’s loan book includes large, institutionally underwritten assets across the U.S., UK, and Europe, including several high-profile office, multifamily, and industrial developments. Borrower names are not disclosed, but loans are typically secured by major properties with well-capitalized sponsors.

For me, BXMT sits near my 8 percent income floor, the zone where the discomfort is the work and where compounding can be meaningful if the dividend proves durable.

4. Why Management Matters

One reason I keep coming back to BXMT is the platform behind it. The company sits inside Blackstone Credit & Real Estate, led by Jon Gray, with real scale in data, sourcing, and workouts. That brings two advantages most mortgage REITs lack:

an information edge that shows up in underwriting and timing, and

workout capability that helps resolve challenged loans rationally.

Watching how Gray’s team navigates this phase is a reminder for me that staying disciplined under pressure is part of the work, not separate from it.

5. The Dividend Picture

The quarterly dividend was reset to $0.47 in July 2024 and has held. In Q2, BXMT earned $0.19 per share after charge-offs and $0.45 before them, so coverage is still tight, but close on a pre-charge-off basis.

Book value sits at $21.04, already net of $4.39 per-share CECL reserves.

That is why I treat the yield as real but not bulletproof. I want earnings and mix to keep trending the right way.

6. What Could Go Right

Office exposure keeps shrinking and originations lean into multifamily and industrial.

Impaired resolutions continue above carrying value, supporting BV and future coverage.

Funding costs improve at the margin after the 65 bps Term Loan B repricing.

7. What Could Go Wrong

Fresh non-accruals outpace resolutions.

Realized losses keep pre-charge-off earnings below the dividend for too long.

CRE values slip again, extending the timeline.

8. Dollar-Cost Averaging Through the Cycle

I am considering weekly purchases rather than taking the position in thirds.

Why that makes sense

Smooths entry across volatility and removes the need to time the bottom.

Each week locks a slightly different yield, which can improve the average if shares drift before recovery.

Fits my “steady engine building” approach.

What to watch for

The plan only works if the thesis holds. If coverage weakens or a cut looms, averaging down adds risk.

Weekly buys still require discipline to pause if fundamentals change.

For now, a slow weekly approach feels like the right balance between patience and participation. If the price drops to around $17 I will consider placing some bigger trades once we are the other side of earnings report in late October.

9. How I’m Handling It

BXMT will be a measured position, not a core holding. I will build slowly through weekly increments and reassess after the 29 Oct call. If coverage moves toward or above $0.47 and book stays near $21, I let reinvestment do the work. If losses widen, I pause and recycle. Lastly, if the price drops to around $17 I will consider placing some bigger trades once we are the other side of earnings report in late October.

10. Wrap-Up

BXMT’s yield is tempting because it reflects real risk. The discount to book and the prior cut already acknowledge the damage. The next phase is about management execution and property-market stability. Q2 showed BV essentially flat and modest loan growth resuming as the team stepped back into origination mode. Progress is uneven, but resolutions and steady earnings support holding the current payout for now.

I am publishing this ahead of Q3 earnings because I want my process clear before new numbers hit: build deliberately, watch coverage and capital, and stay grounded when the market wobbles. In PYE terms, this feels like engine noise, not engine trouble, and I will keep checking the gauges.

PYE Takeaway: Keep your head and your yield, and let time and reinvestment do the work.

If PYE helps you see yield and compounding in a clearer light, consider supporting the project. Every subscription fuels the time I spend running reinvestment models, tracking portfolio income, and translating what I learn into posts we can all build from.

Disclaimer

The analysis and commentary shared here reflect my own research and investment approach. This content is provided for informational and educational purposes only and should not be considered financial advice, a recommendation to buy or sell any security, or an endorsement of any particular strategy. Nothing here is tailored to the investment needs or circumstances of any individual. Charts, graphs, or figures are illustrative only and should not be relied upon as the basis for investment decisions. Please consult a qualified financial advisor before making investment choices that may affect your personal financial situation.

CECL (Current Expected Credit Losses). A forward-looking reserve that estimates potential future loan losses. It’s deducted from book value, so when I say BV is “net of CECL,” it means the loss cushion is already accounted for.