Introduction

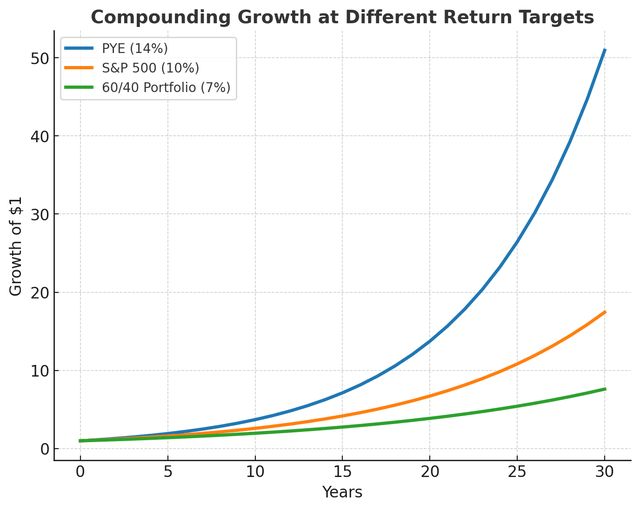

This article lays out my Predictable Yield Engine (PYE) strategy. The thesis is simple: by targeting an 8 percent baseline yield and capturing an additional 5 to 6 percent from capital gains through discount narrowing, NAV growth, and dividend increases, I aim for a 14 percent long-term annual return, which doubles the portfolio about every five years.

In the pages that follow, I explain:

The philosophy behind the PYE and why I built it.

The process I use to select and evaluate holdings, including a deep dive into how I analyze a BDC like Ares Capital.

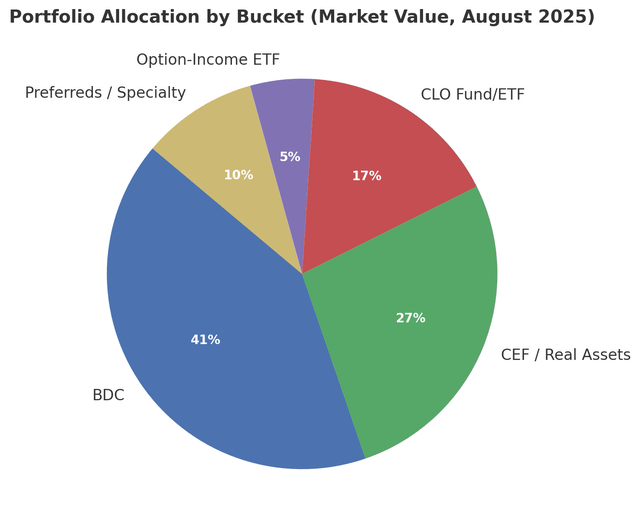

How I balance portfolio buckets (BDCs, CLO funds, CEFs, ETFs, and preferreds) and use account placement (Roth vs Traditional IRAs) to maximize after-tax compounding.

Why valuation discipline is central, with current examples such as (ARCC), (ECC), and (SPYI).

How I define and manage risk through the PYE lens.

What today’s market environment means for the strategy and why I believe it can realistically hit my stretch goal of 14 percent.

I am not looking for income to spend today. I am still several years from retirement, and every dollar produced by the portfolio is reinvested. The objective is to build a machine now that will be fully tuned and reliable when I need it later.

Core Philosophy

The Predictable Yield Engine rests on three principles:

Yield First. Every holding must earn its seat at the table by producing meaningful income. If it does not pull its weight, it does not belong in the portfolio.

Compounding Second. Reinvested distributions are the real driver of long-term wealth. By constantly buying more income-generating assets, the machine builds on itself.

Valuation Discipline Always. Buying cash flow at a discount increases yield and gives optional upside if prices revert toward net asset value.

This is not a hunt for the highest yield at any cost. The portfolio is designed as a system: a diversified mix of income-producing securities, acquired at sensible valuations, that produce predictable cash flows. Those flows are reinvested relentlessly. The maths is what matters. Over years, the compounding becomes more powerful than any short-term fluctuation in price.

Selection Framework

When I look at potential holdings, I start with yield and coverage. For business development companies (BDCs), I want dividends that are covered by net investment income and, ideally, growing. For closed-end funds (CEFs), I check whether distributions are covered and if the fund is trading at a discount to its net asset value. For option-income ETFs like (JEPQ) or (SPYI), I look at whether their strategies have delivered consistent payouts relative to peers.

Valuation discipline is always part of the process. A BDC that trades at a 15 percent premium to NAV may be a fine company, but paying that premium lowers my effective yield and limits future return. With CEFs, the historical discount range matters. Buying a credit fund at a 10 percent discount when its average is 5 percent is attractive. Buying it at a 10 percent premium is not.

How I Do the Work

I do not rely on yield screens alone. For closed-end funds, I track discounts, premiums, and Z-scores on both CEFConnect and CEFData, and I read the fund reports to understand distribution coverage. For BDCs, I review quarterly earnings transcripts and compare net investment income against declared dividends. I also use summary research, such as the weekly BDC report I follow, to spot shifts across the sector. Coverage is calculated by dividing net investment income by distributions, and I focus on funds where the numbers show that payouts are sustainable.

Research Deep Dive: How I Evaluate a BDC

To show what this looks like in practice, consider Ares Capital (ARCC), my largest BDC position. I evaluate it on five fronts:

Non-Accruals. In Q2 2025, non-accruals rose to 2.0 percent of the portfolio at cost and 1.2 percent at fair value, up from 1.5 percent and 0.9 percent in Q1. Those levels remain manageable and below industry averages, but I track them quarter by quarter.

Dividend Coverage. It pays a $0.48 quarterly dividend. Even in low-rate years like 2020 and 2021, it covered the payout with NII, and today coverage is stronger given the higher-rate backdrop.

Fee Structure and Alignment. It charges a 1.5 percent base management fee and 20 percent incentive fee. While standard, the more important factor is that NAV and NII per share have grown over time after fees.

Loan Mix and Diversification. Over 70 percent of it'sportfolio is senior secured loans, spread across software, healthcare, business services, and energy. No single borrower accounts for more than 1 percent of the portfolio.

Valuation vs Peers. At a 12 percent premium to NAV, it is not cheap, but I accept it for the stability and scale. I would not pay that multiple for a thinner platform with rising non-accruals.

That level of analysis is why (ARCC) has a core role. I apply the same lens across all BDCs I consider, always asking whether the business model can support sustainable dividends through the cycle.

Portfolio Buckets

To make the Predictable Yield Engine balanced and resilient, I divide holdings into buckets.

Business Development Companies (BDCs). These provide loans to middle-market firms and pay out high levels of income. My core holdings are (ARCC), FS Credit Opportunities (FSCO), and Blackstone Secured Lending (BXSL). Their yields sit between 8 and 11 percent, supported by scale and diversified portfolios.

CLO Funds and ETFs. This is the higher-octane portion. I own Eagle Point Income (EIC), Eagle Point Credit (ECC), and Janus Henderson’s (JBBB). These instruments invest in collateralised loan obligations and often produce double-digit yields, with the ability to reinvest at wider spreads when base rates fall.

Closed-End Funds (Credit and Real Assets). Examples include Western Asset Diversified Income (WDI), Saba’s (CEFS) ETF, and Cohen & Steers funds focused on infrastructure and real estate. These typically yield 9 to 12 percent, often available at discounts to NAV.

Option-Income Equity ETFs. (SPYI), (JEPQ), and (JEPI) link the portfolio to equity markets while still generating yields of 8 to 12 percent through option writing.

Preferreds and Specialty Funds. Funds such as (PFFA) or select mortgage REIT preferreds provide diversification and stability.

Each bucket plays a role. The BDCs provide stability and scale, the CLO funds deliver higher yield and optionality, the CEFs add valuation-driven opportunities, the equity-income ETFs give equity exposure without losing yield, and the preferreds provide ballast.

Account Placement: Roth vs Traditional IRA

Where I hold each security is just as important as which securities I own. All my PYE holdings sit inside retirement accounts, which means no annual tax drag. That alone gives me a major edge over running this strategy in a taxable account. But I go further by discriminating between Roth and Traditional IRAs.

In my Roth IRA, I hold the highest-yielding, most tax-inefficient assets. That includes CLO funds like (ECC) and (EIC), high-distribution CEFs, and option-income ETFs such as (SPYI), (JEPQ), or (BTCI). These throw off large distributions that would be taxed at ordinary income rates in a taxable account. By placing them in the Roth, I reinvest every dollar today and lock in tax-free withdrawals in the future. That makes the Roth the ideal container for my most aggressive compounding positions. Since the eventual income stream will be completely tax-free, I am comfortable taking on a higher level of risk here than I would in a Traditional IRA.

In my Traditional IRA, I hold steadier, slightly lower-yielding positions such as (ARCC), (BXSL), and diversified credit or infrastructure funds. Withdrawals will be taxed as ordinary income, but having a balance between Roth and Traditional assets gives me flexibility to manage my tax exposure when retirement comes.

If I were running PYE in a taxable account, the results would be far weaker. The tax drag from ordinary income would eat away at compounding. That is why account structure is central to this approach.

Portfolio Balancing

The portfolio is not designed to maximise yield alone. It is meant to run smoothly as a system. Position sizing is part of that. (ARCC) may yield less than (ECC), but it brings stability. (ECC) may yield more, but it comes with volatility. By balancing them, the overall machine keeps running.

At present, my mix produces a weighted average yield of about 10 to 11 percent. That clears my 8 percent floor, gives me reinvestment fuel, and points toward long-term compounding returns near my 14 percent target.

Valuation in Practice

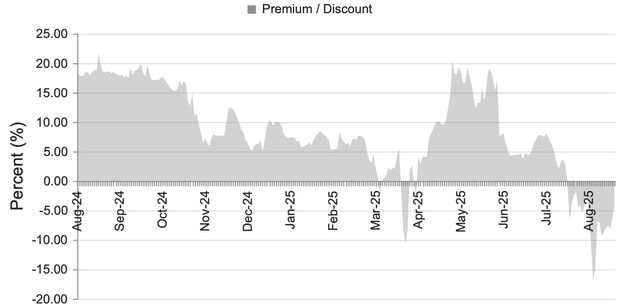

The Predictable Yield Engine is not just about collecting yield. Valuation matters. Here is how it looks in practice with a few current examples, using data as of Friday, August 22, 2025.

Ares Capital (ARCC). Closed at $22.32 vs NAV of $19.90 → 12 percent premium. Yield about 8.6 percent. Stability and low non-accruals justify the premium. My line in the sand is credit quality: if non-accruals at fair value rose above 3 percent for more than two quarters, I would reconsider the size of my position.

Eagle Point Credit (ECC). Closed at $7.04 vs NAV of $7.49 → 6 percent discount. Yield nearly 24 percent. The discount enhances effective yield, though coverage variability means I size it carefully. If distribution coverage dropped below 90 percent for three consecutive quarters, or if NAV erosion outpaced distributions on a sustained basis, I would trim or exit.

(SPYI). Current distribution rate just over 12 percent. No discount/premium because it is an ETF, but option premiums remain strong enough to clear my yield hurdle while maintaining equity exposure. If payouts fell below 8 percent on a 12-month rolling basis, or if premiums collapsed due to a change in volatility regime, I would reduce exposure.

These examples highlight how the framework works in real time. Every holding must clear the 8 percent floor, coverage must be sustainable, and valuation must make sense. Just as important, each position has a clear set of downside markers that tell me when the income machine may no longer be reliable.

Risks

In the Predictable Yield Engine, risk is not defined as price volatility. I actually expect and welcome volatility, since it lets me reinvest income at lower prices. The risks that matter are different:

Permanent Impairment of Income. If a fund cuts its distribution or if net asset value erodes over time, the compounding machine breaks down.

Sustainability of Cash Flows. Every holding earns its seat at the table by producing reliable income. The key question is whether the portfolio of loans, securities, or strategies behind it can keep paying and, ideally, keep growing distributions.

Correlation and Concentration. Holding dozens of tickers means little if they all depend on the same drivers. I diversify across BDCs, CLOs, CEFs, ETFs, and managers so the portfolio does not fail all at once.

This is how I define and manage risk. It is not about avoiding price swings. It is about protecting the flow of income and ensuring the engine keeps compounding year after year.

Measuring Success

I measure success in two ways. First, the portfolio’s weighted average yield. As long as it stays above 8 percent, the engine is running. Second, total return. I track this through time-weighted return and internal rate of return, both of which capture yield plus capital changes. My goal is 14 percent annually.

This simple comparison shows why I aim higher. It puts the Predictable Yield Engine into context against what most investors accept as benchmarks.

Current Market Positioning: Why This Matters Now

Today’s environment gives me confidence that the Predictable Yield Engine can deliver.

Rates at a Plateau. Short-term rates remain elevated (SOFR ~4.35 percent, EFFR ~4.33 percent). That continues to support record NII at BDCs like (ARCC) and (BXSL).

CLO Discounts. ECC trades at a 6 percent discount while paying a 24 percent yield. That disconnect between cash flow and sentiment creates asymmetry.

Option-Income ETFs. SPYI is distributing just over 12 percent, supported by steady volatility premiums. It keeps me tied to the equity market without sacrificing yield.

Defaults Remain Manageable. Depending on methodology, leveraged loan defaults are around 1 to 5 percent. That spread matters, but even at the high end we are nowhere near crisis levels.

The combination is unusual: BDCs are earning record spreads, CLO funds are cheap, and equity-income ETFs are paying double digits. For me, this is precisely the kind of environment where compounding high yields through reinvestment can achieve my stretch goal of 14 percent.

Why It Matters for Other Investors

Most investors my age stick with a traditional balanced portfolio. That approach has its merits, but I wanted something different. I wanted a strategy that leaned into predictable cash flows, maths-driven compounding, and disciplined valuation. That is what PYE offers.

The framework is flexible. Someone closer to retirement could spend the income rather than reinvest it. Someone younger could push harder into higher-yielding funds and let compounding run even longer. The tools are available to anyone, since all my holdings are publicly traded.

The key is predictability. By focusing on cash yield, valuation discipline, and reinvestment, an investor can build a system that compounds steadily regardless of market sentiment.

Closing Thoughts

I cannot predict what markets will do in any single year. What I can rely on is the maths. If I consistently collect an 8 percent yield, reinvest it, and capture an additional 5 to 6 percent from capital gains through discount narrowing, dividend growth, and modest appreciation, the compounding works in my favour. That is the essence of the Predictable Yield Engine.

This is not about speculation or timing. It is about building a portfolio that pays generously today, compounds steadily through reinvestment, and will be fully ready when I need it in retirement.

That is the discipline of the Predictable Yield Engine: every holding must earn its seat at the table. The portfolio is not a collection of hunches or favourites. It is a working machine where each part has a role and contributes to compounding.

I will provide quarterly updates to show how the portfolio is progressing and publish deep dives on individual tickers that readers can evaluate for themselves. My aim is to share both the framework and the practical tools to help investors build their own income engines.

If PYE helps you see yield and compounding in a clearer light, consider supporting the project. Every subscription fuels the time I spend running reinvestment models, tracking portfolio income, and translating what I learn into posts we can all build from.

Disclaimer

The analysis and commentary shared here reflect my own research and investment approach. This content is provided for informational and educational purposes only and should not be considered financial advice, a recommendation to buy or sell any security, or an endorsement of any particular strategy. Nothing here is tailored to the investment needs or circumstances of any individual. Charts, graphs, or figures are illustrative only and should not be relied upon as the basis for investment decisions. Please consult a qualified financial advisor before making investment choices that may affect your personal financial situation.

Thanks for taking the time to write up your approach. Very similar to my income portfolio. Couple questions if you don't mind:

Do you keep track of total return over the course of, say, a year to weed out underperforming tickers? Volatility can be good but relentless price/nav drag is a big headwind imo. XFLT comes to mind...

Is this yield-based approach complemented by any buy/hold equities accounts to produce an overall balanced portfolio, or is everything invested along these lines.

When would you consider FSCO overvalued? It has gone from deep discount to basically even with nav in the last year..

Thanks again.

fwiw, i avoid equity linked covered call funds because the market is at nose bleed valuations. also 34% of spx is in the top 7 stocks. current times are very reminiscent of the late 1990's. i don't know when the top will come, but i don't want to think about it. the only covered call funds i use are igld and slvo.