September 2025 Update: Why the Predictable Yield Engine Holds Steady

Why the PYE portfolio keeps compounding through rate cuts

I designed my Predictable Yield Engine (PYE) portfolio to deliver a 14 percent annual return over the long run, with at least 8 percent of that coming from dividends. The idea is simple. If you can create a reliable stream of high-yield cash flows, reinvest them month after month, and buy at disciplined valuations, you can build wealth that compounds predictably through market cycles.

Think of it like a car engine. The PYE isn’t designed for bursts of speed. It is designed to run smoothly and consistently, producing steady power no matter the conditions. Some parts of the portfolio generate high-octane yield, some provide ballast and stability, but together they form an engine built for durability.

This September review shows that the core principles of the PYE are holding up. Base dividends are intact, spillover income is cushioning payouts, and discounts are creating new opportunities to reinvest at attractive forward yields.

Spillover income provides a cushion

Spillover income is undistributed earnings that managers can use to support future dividends. This is critical to our design, because the PYE requires a stable base of income that can keep compounding through rate cycles.

ARCC (Ares Capital) reported Q2 net investment income of $0.59 per share against its $0.48 dividend. That coverage not only secures the current payout but also adds to the spillover buffer. NAV/share rose to $19.90 from $19.82 in Q1, a sign of balance sheet stability.

BXSL (Blackstone Secured Lending) reported Q2 NII of $0.77 per share, matching its dividend. Even with rate cuts in view, base earnings are strong enough to keep distributions steady.

BBDC (Barings BDC) reported Q2 NII of $0.28 per share, comfortably covering its $0.26 dividend. This demonstrates that payouts are being earned, not eroded.

Supplemental dividends are not core

Several managers, including PBDC (Putnam BDC Income ETF), have stressed that most BDCs can handle up to 200 basis points of rate cuts while maintaining base dividends. What will fade first are supplemental payouts.

In the PYE, supplementals are never part of the plan. They are welcome bonuses, but the engine is designed to hit its 14 percent IRR on base income alone. That discipline protects the system from disappointment and keeps the strategy predictable.

NAV coverage is the key filter

NAV coverage tests whether a fund’s NAV total return matches or exceeds its NAV yield. If it does, the payout is being earned. If it does not, the distribution is eroding NAV.

For example, a fund that produces a 10 percent NAV total return while paying an 8 percent NAV yield is covering its payout. Another that produces only 6 percent NAV total return while paying 8 percent is slowly bleeding NAV.

XFLT declared a $0.070 monthly distribution for September through November. NAV slipped slightly in Q2, but coverage stayed above 100 percent.

KIO maintained its $0.1215 monthly distribution, supported by its floating-rate loan portfolio.

This is why I review every position in PYE against this filter. Any fund that fails to cover its payout is a candidate for reduction.

Discounts create opportunity

Buying at a discount gives us more income for every dollar invested, and optional upside if discounts narrow. This is where valuation discipline adds to compounding.

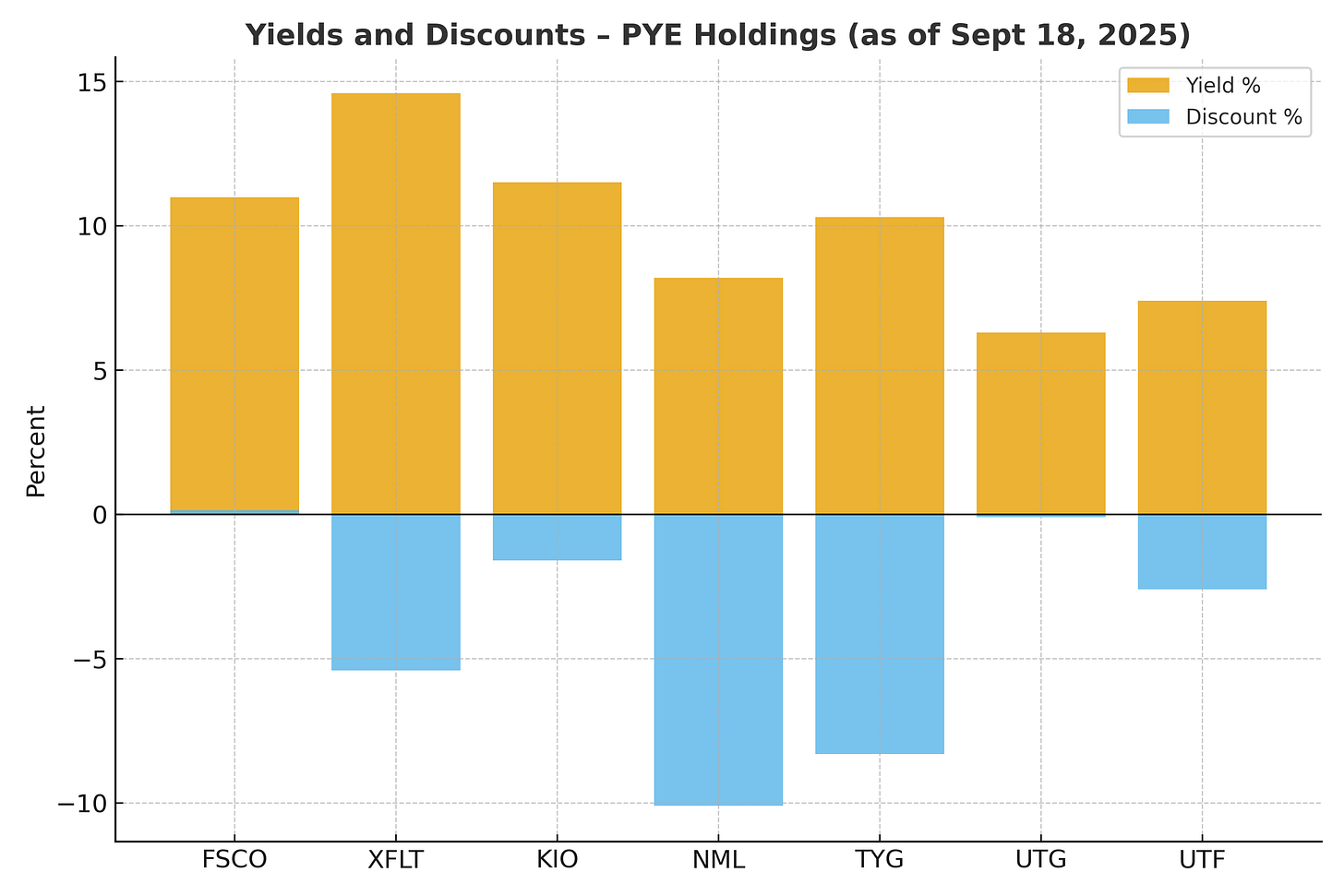

FSCO trades essentially at NAV ($7.40 price vs $7.39 NAV) with a 10.99 percent yield. The opportunity here is in yield and steady coverage rather than discount.

XFLT trades at a 5.4 percent discount and yields ~14.6 percent.

KIO trades at a 1.6 percent discount and yields ~11.5 percent.

NML trades at a 10 percent discount and yields ~8.2 percent.

TYG trades at an 8.3 percent discount and yields ~10.3 percent. Activist investor Saba has been building positions in NML and TYG, often a catalyst for buybacks or restructuring that helps close discounts.

That is why I am allocating selectively into XFLT, KIO, NML, and TYG, where yield and valuation together create an attractive entry.

Defensive ballast

Not every slot in the portfolio needs double-digit yield. UTG yields ~6.3 percent at NAV, and UTF yields ~7.4 percent at a 2.6 percent discount. Their utilities and infrastructure focus gives the engine ballast, smoothing volatility without sacrificing long-term performance.

Conclusion

The September updates confirm that the Predictable Yield Engine is doing exactly what it was built to do. Base dividends are covered, spillover income strengthens the foundation, and valuation discipline is creating new entry points.

This is why I reinvest every month, keep coverage as a strict filter, and buy selectively when discounts open up. Like a car engine running at steady RPM, the PYE is generating consistent power from income. With this design, I can target a 14 percent annual return and know that the compounding process will keep driving forward, cycle after cycle.

If PYE helps you see yield and compounding in a clearer light, consider supporting the project. Every subscription fuels the time I spend running reinvestment models, tracking portfolio income, and translating what I learn into posts we can all build from.

Disclaimer

The analysis and commentary shared here reflect my own research and investment approach. This content is provided for informational and educational purposes only and should not be considered financial advice, a recommendation to buy or sell any security, or an endorsement of any particular strategy. Nothing here is tailored to the investment needs or circumstances of any individual. Charts, graphs, or figures are illustrative only and should not be relied upon as the basis for investment decisions. Please consult a qualified financial advisor before making investment choices that may affect your personal financial situation