First principles and goals

My Predictable Yield Engine has one job: compound steadily.

Target: 14% total return over time, with at least 8% from cash yield.

Method: buy income at sensible entry points, reinvest, and let discount capture add optional upside.

Rule: every holding must earn its seat on income durability or clear compounding power. I do not chase premiums.

Rate cuts lower floating coupons, but they also reduce CEF borrowing costs and often widen discounts. That is when I can pick up yield at better math and let mean reversion do some work.

Where this fits the PYE engine

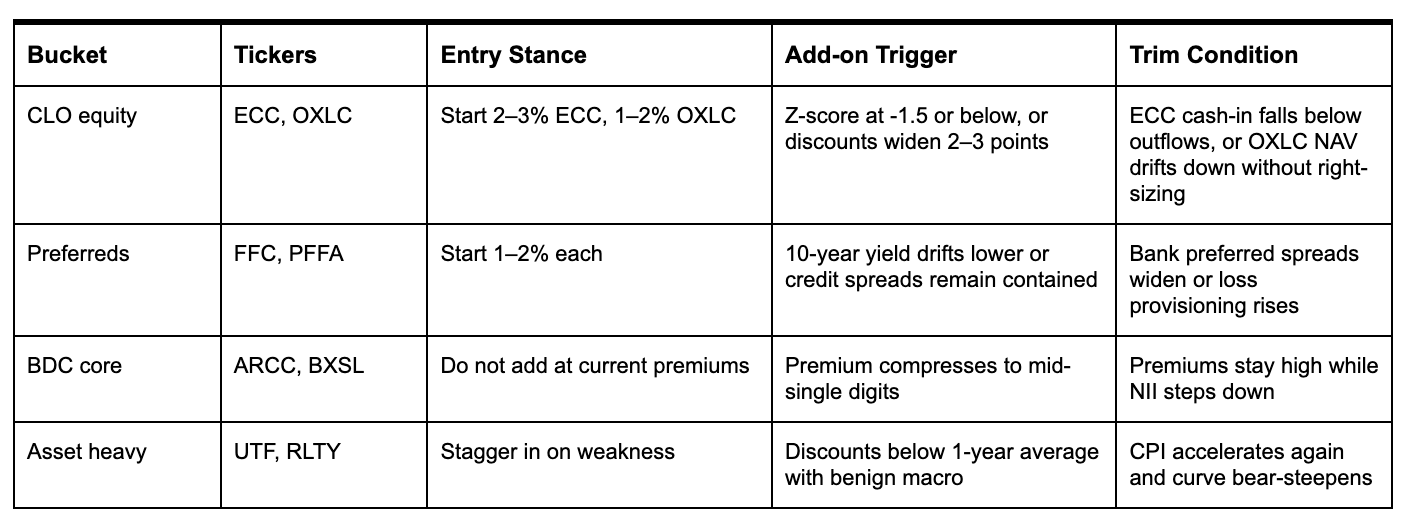

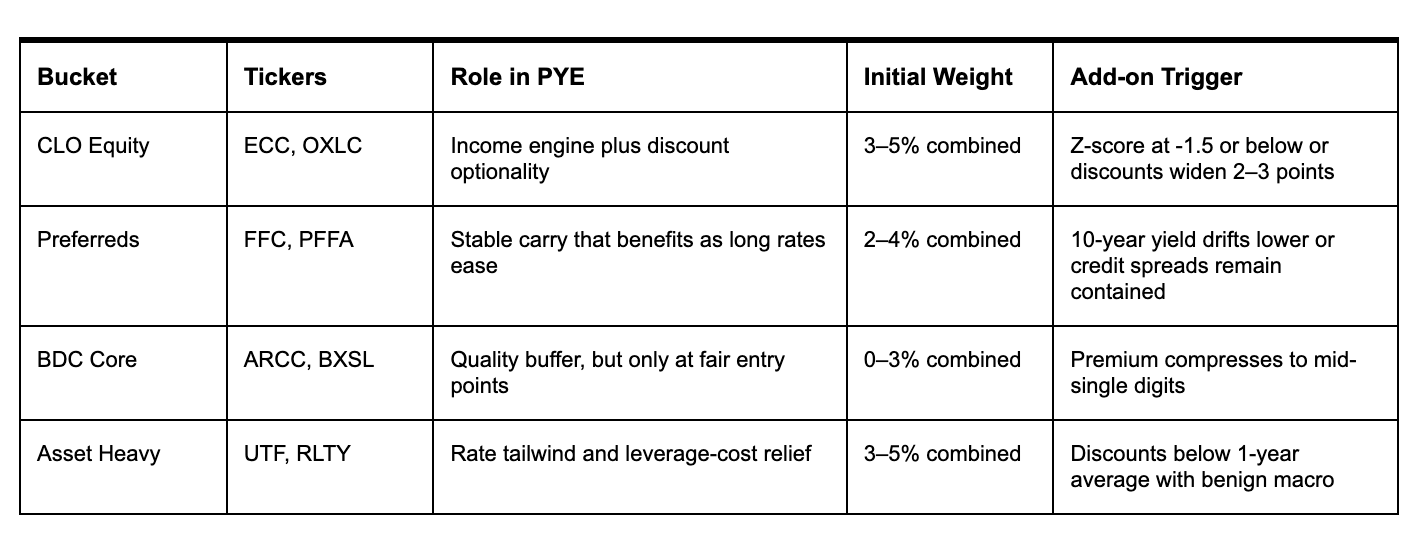

I am building a barbell of high-income buckets plus rate-friendly assets. The aim is to keep the income floor near 8 percent while preserving a path to 14 percent with reinvestment and discount mean reversion.

Income engine: CLO equity and preferreds drive ongoing cash generation.

Quality buffer: BDCs are best-in-class lenders, but I only buy them at fair entry points.

Rate tailwind: asset-heavy funds benefit as leverage costs fall and duration helps.

What I am buying first

1) CLO equity for resilient cash and discount mean reversion

Tickers: ECC, OXLC

ECC. Market discount about -1.4% versus Q2 NAV $7.31. I start 2–3% and add only if the 1-year Z-score stays at -1.5 or below or the discount widens another 2–3 points. I track recurring cash coverage each quarter. In Q2, cash-in $0.69 per share versus outflows about $0.61 per share.

OXLC. Management’s July 31 NAV estimate $4.13–$4.23 puts the fund at a low-teens discount at recent prices. I start 1–2% and use a trailing stop because it is more reset sensitive.

Why this bucket

CLO equity cash flows are less sensitive to base-rate cuts than CLO debt. I get paid to wait with a shot at discount mean reversion.

2) Preferreds for carry now and a tailwind if long rates ease

Tickers: FFC, PFFA

FFC. Modest discount and roughly 8 percent distribution. I allocate 1–2% for active preferred selection and the chance for discount tightening.

PFFA. Liquid sleeve with an enhanced approach. I allocate 1–2% and refresh the 30-day SEC yield on publish day from the sponsor page.

When I trim

If bank preferred spreads widen or loss provisioning picks up, I reduce and shift back toward floating-rate holdings.

3) BDC core, but only at fair entry points

Tickers: ARCC, BXSL

ARCC. About 12.1% premium to Q2 NAV $19.90. I wait for a mid-single-digit premium before adding.

BXSL. About 9.2% premium to Q2 NAV $27.33. Same stance.

What to watch

Q3 non-accruals and realized losses versus history. If NII steps down with cuts and premiums stay high, I rotate into discounted credit holdings. I anchor decisions to the 10-Q NAVs.

4) Asset-heavy rate winners where lower leverage costs help

Tickers: UTF, RLTY

UTF. Not at a deep discount today. I scale in on weakness, not a table-pounding buy.

RLTY. Discounted, but not in the teens right now. I like 2–3% with a buy-the-dip posture.

When I trim

If CPI accelerates again and the curve bear-steepens, I cut UTF and RLTY and recycle into floating-rate holdings.

How I size the basket

How this maps to the PYE goals

Income floor toward 8 percent. CLO equity and preferreds do the heavy lifting on cash yield.

Path to 14 percent. Discount capture and reinvestment add optional upside in normal markets, while rate-friendly assets provide price tailwinds if cuts proceed.

Discipline. I keep BDCs on a short leash at premiums and scale buckets only when the entry math is on my side.

Summary

This plan keeps the Predictable Yield Engine true to its job. I am buying income at sensible entry points, letting discount capture do quiet work in the background, and refusing to pay up for quality when patience is the better option. CLO equity and preferreds carry the income floor toward 8 percent. UTF and RLTY add a rate tailwind as leverage costs ease, sized to stagger in rather than swing. ARCC and BXSL stay on ‘add to list’ until premiums compress to fair entry points. Execution is simple. Add only when Z-scores or discounts say the odds are with me. Trim when inflation accelerates again or credit spreads flash. Reinvest systematically. The goal remains the same. A steady 8 percent cash engine, plus 2 to 4 percent from discount capture and compounding, gets me back on track for 14 percent total return without relying on an increasingly tiring bull market.

If PYE helps you see yield and compounding in a clearer light, consider supporting the project. Every subscription fuels the time I spend running reinvestment models, tracking portfolio income, and translating what I learn into posts we can all build from.

Disclaimer

The analysis and commentary shared here reflect my own research and investment approach. This content is provided for informational and educational purposes only and should not be considered financial advice, a recommendation to buy or sell any security, or an endorsement of any particular strategy. Nothing here is tailored to the investment needs or circumstances of any individual. Charts, graphs, or figures are illustrative only and should not be relied upon as the basis for investment decisions. Please consult a qualified financial advisor before making investment choices that may affect your personal financial situation.

Just out of interest, where are you parking your cash until you hit your entry points, to ensure it continues to work for you?