Primary Health Properties: An 8% NHS-Backed Yield at a Rare Discount

Hiding in plain sight: the landlord behind Britain’s GP surgeries

Most investors will not have heard of Primary Health Properties (PHP). It is a UK-listed REIT that owns GP surgeries, community health centres and related healthcare facilities. It is not glamorous, but it is vital infrastructure.

Right now PHP sits squarely in my Predictable Yield Engine lens because it combines two things I look for. First, secure government-backed income. Second, a valuation anomaly that is historically unusual.

What PHP Does

UK-listed REIT, now with about £6bn in healthcare assets after the Assura acquisition.

Roughly 90% of rental income comes directly from the NHS. The balance comes from GP practices and pharmacies delivering NHS services.

Leases are long, inflation-linked and the portfolio is essentially fully occupied.

It functions like a bond proxy: predictable income backed by the government.

Valuation Snapshot

Share price: about 89p (Sept 2025).

Adjusted NTA: 106.2p (30 June 2025).

EPRA NDV: 113.9p.

Discount to NAV: 16 to 22%, which is unusual for PHP as it has mostly traded at or above NAV.

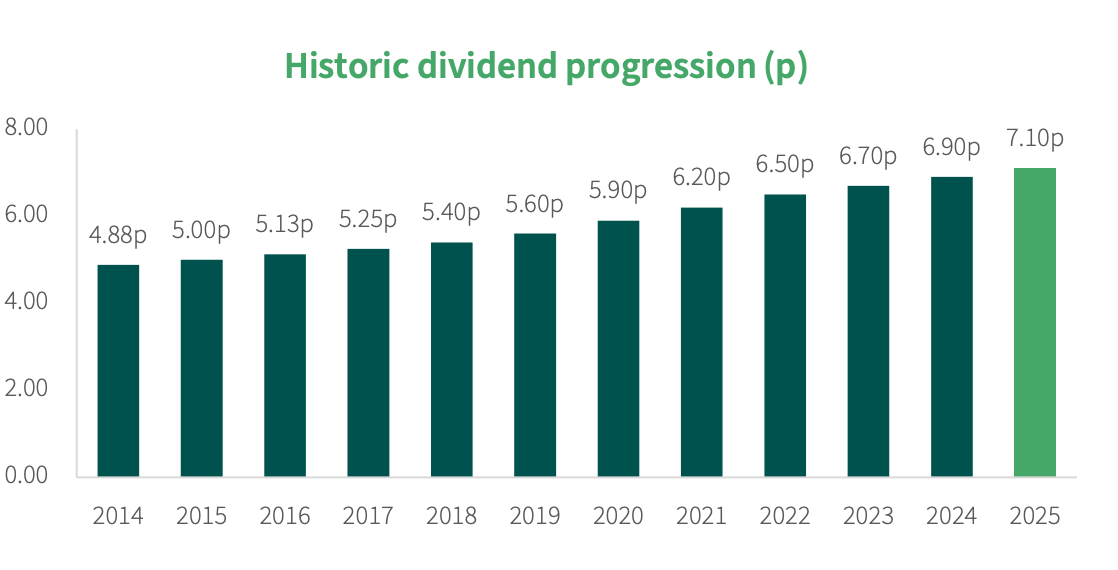

Dividend: 1.775p quarterly, 7.1p annualised.

Yield: around 7.9%.

Catalysts

Rate cuts. Falling gilt yields will make an 8% yield more attractive. Lower base rates also reduce refinancing costs.

Assura deal. PHP beat KKR and Stonepeak to acquire Assura. Shareholders approved the deal with 99.3% support. The CMA review is still pending, which means integration benefits may not be felt until 2026, but the combined company will be a £6bn specialist landlord of healthcare property.

Policy support. The NHS Health Plan is pushing for more modern, community-based facilities. That plays directly to PHP’s strengths.

PYE Lens

Yield. At almost 8%, PHP clears my threshold for income that earns its seat.

Discount. A 16–22% discount to NAV gives optional upside if sentiment improves. PHP has only traded at this kind of discount during periods of market stress.

Compounding. Quarterly dividends reinvested at today’s discount amplify long-term return.

Risks. CMA approval is outstanding. Integration synergies may take longer to show up. NHS funding pressure is always a background concern.

Scenarios

Bull case. CMA clearance, Assura synergies and rate cuts allow a re-rating to NAV. That would mean about 25% total return over the next 12–24 months.

Base case. Discount narrows modestly but yield holds. That gives a 10–12% annualised return.

Bear case. Rates stay high, CMA review drags or integration is messy. Shares drift down, but the yield continues to pay investors while waiting.

Why It Matters for PYE

The Predictable Yield Engine works best when the math of compounding is tilted in our favour. PHP will not deliver explosive growth, but it does offer a rare opportunity to lock in an 8% NHS-backed yield at a discount that seldom occurs. If rates move down and the Assura integration proceeds, the upside is real. If not, you are still being paid every quarter to hold a defensive, government-backed income stream.

That is exactly what PYE is designed to capture: predictable yield plus valuation discipline, creating compounding power over time.

If PYE helps you see yield and compounding in a clearer light, consider supporting the project. Every subscription fuels the time I spend running reinvestment models, tracking portfolio income, and translating what I learn into posts we can all build from.

Disclaimer

The analysis and commentary shared here reflect my own research and investment approach. This content is provided for informational and educational purposes only and should not be considered financial advice, a recommendation to buy or sell any security, or an endorsement of any particular strategy. Nothing here is tailored to the investment needs or circumstances of any individual. Charts, graphs, or figures are illustrative only and should not be relied upon as the basis for investment decisions. Please consult a qualified financial advisor before making investment choices that may affect your personal financial situation.

Added today in my ISA, diversifying away from renewables and uk financials. Yield 7.71%. Excellent post, thanks.