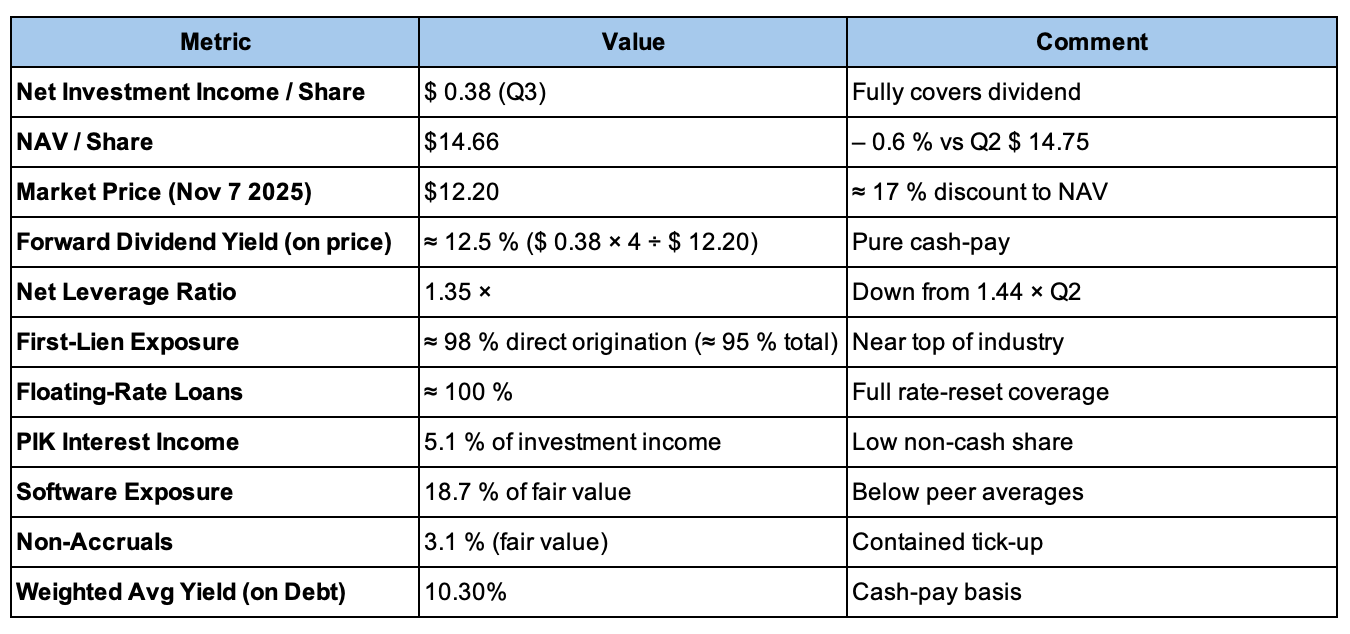

Apollo’s $MFIC: 12.5% Covered Yield at a 17% Discount

Decoding “Top of the Capital Structure, No PIK, Less Software”

When James Zelter, Co-President of Apollo Global Management, told investors that the firm has been “preaching top of the capital structure, no PIK, less software,” he wasn’t reciting marketing copy. He was laying out the philosophy that now guides the world’s most powerful credit platform and, by extension, a map for where disciplined yield investors should be looking next.

For those of us running portfolios through the Predictable Yield Engine (PYE), that single line was a cheat code for the next phase of compounding.

1. The Shift Apollo Is Seeing

Zelter expanded on that comment:

“Everywhere I went, there was massive need for evergreen compounding retirement income. The ability to generate high-quality, compounding, robust yield is a secular trend.”

– James Zelter, Apollo Global Management Q3 2025 Earnings Call, November 4 2025

That isn’t hyperbole; it’s a data point. After a decade of speculative growth, capital is migrating toward contractual, cash-pay yield—the kind that funds pensions and endowments without mark-to-market anxiety.

Apollo’s MidCap Financial platform already delivers it: billions in first-lien, floating-rate loans originated each quarter. When Zelter says “evergreen compounding,” he’s describing that machine.

2. From Scattershot to Focus

A few weeks ago I noted that scattershot updates don’t build conviction. This one does. It’s focused on MidCap Financial Investment Corporation (NASDAQ: MFIC) the listed BDC that turns Apollo’s credit philosophy into a public vehicle.

It’s also a holding in my PYE portfolio. Every position there must earn its seat through yield, valuation, and compounding efficiency.

3. Decoding Apollo’s Playbook Through the PYE Lens

5. What “Top of the Stack” Really Means

At 98 % first-lien, MFIC owns the safest slice of middle-market credit. This is yield earned from seniority, not leverage. That structural priority keeps NAV stable and income predictable—the mathematical foundation of compounding.

6. The “No PIK” Discipline

Only about 5 % of MFIC’s income is PIK interest. Across the sector, the median runs closer to 8–10 %. On $ 82.6 million of quarterly income, that gap translates to roughly $ 2.5 million more cash actually collected each quarter. That’s the difference between reported yield and real yield.

7. Less Software = More Predictability

MFIC’s 18.7 % software exposure is capped by design. BXSL sits around 20 %, ARCC near 25 %. The rest is healthcare, media, consumer services, and asset-based lending—sectors with cash flow and collateral.

In a higher-for-longer world, cash-flowing, asset-backed borrowers have predictable earnings; software borrowers reliant on growth multiples do not. That’s the hidden meaning behind “less software.”

8. Credit Quality and the Merx Reset

Non-accruals rose to 3.1 %, driven by a few idiosyncratic credits. The bigger story was the Merx Aviation repayment:

“Merx repaid $ 97 million during the quarter, reducing exposure from 5.6 % to 3.3 %, with another $ 25 million expected by early 2026.”

That shift pulled risk out of the portfolio and recycled capital into core first-liens—boring, profitable, and compounding.

9. Rate-Cut Readiness

Every loan floats. When the Fed cuts, income will dip, but funding costs are already falling. In October MFIC lowered its revolver spread by 10 bps and its CLO AAA coupon by 91 bps. That’s how you protect margins without chasing yield. MFIC’s own sensitivity analysis (Supplemental p. 16) shows a 100 bp rate cut would reduce annual NII by ≈ $ 9.4 million, or ≈ $ 0.10 per share, a manageable impact given current coverage.

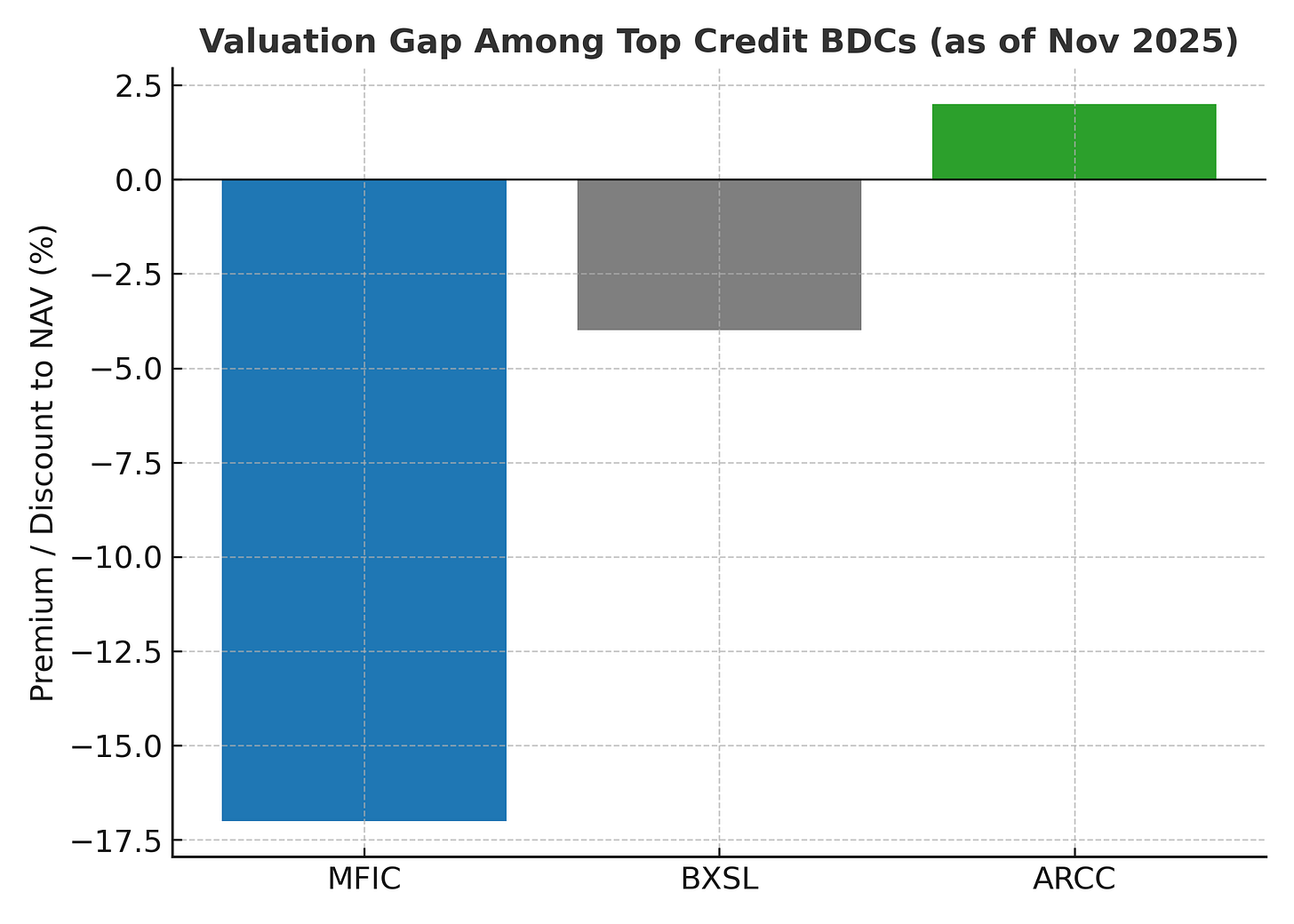

10. The Valuation Disconnect

MFIC doesn’t trade at par; it trades like a distressed company —$ 12.20 against $ 14.66 NAV, a 17 % discount.

BXSL has now reported Q3 as well, confirming a 4 % discount to NAV ($ 26 vs $ 27.15). ARCC, with more equity and higher PIK, still sits at a 2 % premium.

The market is not just inverted; it’s irrational. MFIC’s pricing implies three times the risk of BXSL. The numbers say otherwise.

For PYE investors, that discount is the edge: buy Apollo’s institutional-grade credit book for 83 cents on the dollar and collect a fully covered 12 ½ % cash yield while you wait for sentiment to normalize.

11. Yield Quality and Coverage

The 12 ½ % yield isn’t a trap. MFIC earned $ 0.38 and paid $ 0.38. Coverage is 100 %. No return of capital. The discount creates the yield; the cash flow secures it. That is predictable income born of mispricing—textbook PYE math.

12. Peer Check (Nov 2025 Prices – Updated After BXSL Q3 Results)

BXSL delivered another strong quarter—$ 0.82 NII per share, 106 % coverage, and only 0.1 % non-accruals while maintaining a 97.5 % first-lien book and a 4 % discount to NAV. That makes it the cleanest large-scale read-through for institutional credit quality. MFIC, by comparison, trades 17 % below NAV despite a nearly identical structure and 100 % coverage. The market continues to misprice Apollo’s credit engine relative to Blackstone’s. If MFIC’s discount narrows to BXSL’s level (≈ 4 %), investors capture ≈ 14–15 % price upside plus a 12 ½ % cash yield—roughly 25 % total-return potential on institutional-grade credit.

Readers will notice that MFIC’s 3.1 % non-accrual rate looks higher than the near-zero figures posted by BXSL (0.1 %) and ARCC (1.0 %), but context matters. Most of MFIC’s non-accrual exposure stems from the Merx Aviation repayment cycle and remains senior-secured, keeping potential losses limited. The number should normalize as those loans roll off.

13. PYE Takeaways

1. Discount as Opportunity.

You’re paid 12 ½ % in cash to own a portfolio trading 17 % below NAV. That is forward yield, not risk.

2. Yield without Illusion.

Coverage is 100 %; PIK is 5 %. The income exists because of price, not engineering.

3. Capital-Stack Discipline.

98 % first lien means high recoveries even in stress. You’re buying seniority at a junior valuation.

4. Platform Advantage.

MidCap origination feeds MFIC the same deals Apollo sells to institutions. The discount is the market’s error, not the model’s.

5. Patience as Edge.

While others flinch, you collect 12 ½ % to wait. That is how compounding quietly wins.

14. The Bigger Lesson

The next decade of credit alpha will come from discipline, not daring. Apollo has already published the formula: top of the capital structure, no PIK, less software.

MFIC is that formula in practice—institutional credit for public markets at a 17 % discount. That’s the kind of asymmetry the Predictable Yield Engine was built to find.

15. Looking Ahead

ARCC has already reported solid Q3 results—core EPS of $ 0.50, NAV up to $ 20.01 from $ 19.90 last quarter, and non-accruals steady at 1.8 % of cost (1.0 % fair value). Its modest 2 % premium to book remains intact, showing that the market still rewards scale over structure.

BXSL’s new report confirms the sector’s underlying strength—strong coverage, minimal credit losses, and institutional-grade underwriting. MFIC’s discount now looks even more disconnected from fundamentals. The next step for PYE is tracking whether that gap starts to close as the market digests these results.

16. Closing Reflection

When a $ 900 billion asset manager with about $ 400 billion in Credit says its edge is “top of the capital structure, no PIK, less software,” we listen!

MFIC is a cheat code in public form: a 12 ½ % cash yield fully covered by earnings and a 17 % discount to NAV for the same assets institutions pay par to own.

That isn’t speculation. That’s compounding at work.

Data Sources: MFIC Q3 2025 Press Release and Supplemental Information (Sep 30 2025); BXSL Q3 2025 Earnings Presentation (Nov 11 2025); ARCC Q3 2025 Earnings (Oct 28 2025); Apollo Global Management Q3 2025 Earnings Call (Nov 4 2025).

Note: At time of publication I hold a small position in MFIC, comprising <1% of the PYE portfolio.

If PYE helps you see yield and compounding in a clearer light, consider supporting the project. Every subscription fuels the time I spend running reinvestment models, tracking portfolio income, and translating what I learn into posts we can all build from.

Disclaimer

The analysis and commentary shared here reflect my own research and investment approach. This content is provided for informational and educational purposes only and should not be considered financial advice, a recommendation to buy or sell any security, or an endorsement of any particular strategy. Nothing here is tailored to the investment needs or circumstances of any individual. Charts, graphs, or figures are illustrative only and should not be relied upon as the basis for investment decisions. Please consult a qualified financial advisor before making investment choices that may affect your personal financial situation.

Couldn't agree more. 'Capital migrating' feels like a smart read, but I'm watching closly.